So I’ve decided to amp things up a little on this sleepy Substack. This episode has turned out to be quite a ride. I can promise you this: below I will be taking you from Oxford to Dan Bilzerian. There will be 2 erstwhile bearded men with CFAs. There will be well meaning social enterprises tracking coal power plant activity. There are a few of those actually. There will be a less than erstwhile Instagram brat spending daddy’s ill gotten gains, also with a beard. Enron even gets a mention. And linking all of these things? Nothing less than spatial finance. It’s a piece I realise I’ve been waiting my whole career to write, so let’s dive in.

Synmax is the second geospatial company that I have profiled from legendary natural gas trader Bill Perkins. The first was Skyfi:

Finally I can say we have gotten into spatial finance. Eric Anderson, CTO of Synmax, was a very stimulating guest. What made it all the more meaningful to me is he is a chartered financial analyst. This is someone who has survived an exam with a 38% pass rate. I only have a certificate in Value Investing: An Introduction which I paid half price for due to studying online with a friend. So I felt like a school basketball player dribbling (literally) with someone from the NBA. I especially appreciated his willingness to cover the philosophical side of the AI question towards the end. Eric also had fantastic advice for an apprentice in the final question. As such, this guest, in addition to having significant quantitative capacities, was game for the qualitative questions too. Have a watch:

Or a listen:

Overall I feel incredibly proud to have gotten to this point with the podcast. I have had a very strong interest in spatial finance since the field emerged a few years ago. When I discovered it, I finally I felt that I had been recognised for my unique combination of obsession with equities analysis and career in geospatial.

Financial Geography

So I looked around for initiatives and groups to join and signed up for the academic newsletter of FinGeo, presently administered by the secretary Dr Karen Lai. I didn’t really understand at the time, but it is about something distinct from spatial finance. FinGeo is about financial or economic geography. Economic geography examines the spatial differences in accumulation of wealth:

A memorable occasion illustrating my ignorance about the difference between economic geography and spatial finance occurred in October 2020. I was attending the FinGEO AGM via Zoom. I was the only one talking about equities trading applications of the discipline. I was met with a frantic silence except for the polite moderator. She could only bring herself to utter the term ‘practitioners’ in reference to those on trading desks in The City or on The Street trying to gain an edge from her colleagues’ academic work. What the group instead produces is maps like this:

Figure 1. Map of foreign exchange trading in 2013 (click it for source).

This is from a leading light in the field of financial geography, Oxford Professor Dariusz Wójcik. The map is very interesting. It shows volume of foreign exchange trading by country and currency. A curious pattern emerges where Singapore, Australia, Hong Kong, Japan, Switzerland, France, Germany all seem to do about the same amount of foreign currency trading. The UK and the US are in their own tier, with the UK apparently doing slightly more than the US (albeit 10 years ago)! Very large countries either population or land-wise do not dominate on the world in foreign currency trading (China, India, Russia are all small pie charts). We are immediately forced to ask why.

As it turns out, I’ve done a bit of financial geography myself in an earlier version of this podcast called The Geospatial Investor:

Here I made a web map of the world’s stock exchanges, asking the same question as Professor Wójcik. Why do some stock exchanges have market capitalisations of the order of $USD20T in the US, but of the order of only $USD1-2T in places like Brazil or Australia?

Figure 2. Map of the world’s largest stock exchanges (click it for full map).

In an at times awkwardly worded blog on what financial geography is, Professor Wójcik issues a call to arms. He first puts the 20th Century’s skyscrapers filled with hard-bitten CFAs on the same level as the pyramids of ancient Egypt and gothic cathedrals of the Middle Ages. Then he contends that these citadels have nevertheless flown under the radar of social scientists. He then embarrasses social scientists by pointing out the consequences of their blindness to the world of finance. It means that those who would have us believe they can diagnose societal ills are themselves ill-equipped to anticipate some of the greatest social disasters. For example, the effect of things like predatory home mortgage lenders targeting racial minorities in the lead up to the Great Financial Crisis.

If there is one thing one would want to be able to do as a social scientist, it would be to at least predict large, unmissable social disasters. The ones that kill lots of people. Let’s get straight to the point. The BMJ reports that:

There were an estimated 4884 (95% confidence interval 3907 to 5860) excess suicides in 2009 compared with the number expected based on previous trends (2000-07). The increases in suicide mainly occurred in men in the 27 European and 18 American countries; the suicide rates were 4.2% (3.4% to 5.1%) and 6.4% (5.4% to 7.5%) higher, respectively, in 2009 than expected if earlier trends had continued. For women, there was no change in European countries and the increase in the Americas was smaller than in men (2.3%).

Again, if there was one way that social science and related disciplines might make themselves useful to society, it would be to accurately forecast excess suicides. As awful as that term is. Professor Wójcik’s call to arms is for these typically anti-capitalist disciplines to suddenly become very familiar with finance. If they do not, they will fail society through being unable to protect it from damage caused by poorly managed finance.

So I suppose we are back to the stunned, slightly rage-filled silence I invoked on that FinGeo call. I suspect, for good reasons discussed below (yes, Dan Bilzerian is involved I kid you not), the hedonistic filth that can accompany finance is what makes it hard for well meaning academics to productively engage with finance. One can, after all, only achieve so much whilst holding your nose with one hand. But they will just have to start manning up. I perceive FinGeo, with which Professor Wójcik is associated, as being an example of a research collective that is doing so. That is why I was met with a caustic silence for being a practitioner. They are about how to protect society from them.

Academic Spatial Finance

So we’re still in 2020/early 2021 in the story so far. At that particular point, I had not come to understand financial geography. I had not made my global stock exchange map or looked at FinGeo’s foreign exchange activity map. I had not started asking questions about geographically-determined wealth accumulation. I was still searching for a hardnosed, pragmatic trading crowd exploiting geospatial analysis for an edge. This continued to elude me as I took in the Spatial Finance Initiative 2019 conference:

With the talk by someone from JP Morgan, there was admittedly an inkling of the brethren I sought at Carto’s 2021 Spatial Data Science in Financial Services Summit:

But it was just one guy. This is not to dismiss either event, or even the erstwhile academics of FinGeo doing good for society by unpicking money flows and the ensuing contours of privilege with the aid of geography. There were also some truly inspiring talks in the 2021 launch of the first Annual Spatial Finance State and Trends Report:

The one that fascinated me the most was the eDNA surveys of Nature Metrics. Through nothing more than a water sample, one is able to detect species living in it through analysing the DNA in the environment (‘eDNA’) from these species. This could come from carcasses, shed skin, faeces and the like. One may understand my feeling, however, that as much as I appreciate efforts to steward the force of nature that humans have become, I was missing my securities analysis comrades.

Despite my hankering for the drama of the markets, recognition of academic work here in two extra ways is in order. In the last video above, the dashing leader of Oxford’s Spatial Finance Initiative, Ben Caldecott, gives a handy definition of the field and endorsement of the power of geospatial more broadly:

We define spatial finance as the integration of geospatial data and analysis in financial theory and practice. We think spatial finance is mission critical for aligning finance with sustainability… we also think it’s got a hugely, potentially, transformational role across a wider range of financial use cases beyond those focused on climate change and the environment.

What analysis then has his group performed? Again with reference to the last video above, if you skip to the 1:05hr mark you will see the introduction of the Spatial Finance Initiative’s GeoAsset datasets by a New Zealander, Dr McCarten, who is also a CFA (level III no less!):

Amongst many attributes, these datasets have the coordinates of assets along with exchange and ticker codes:

Figure 1. GeoAsset dataset of 119 beef abattoirs across the 5 largest meatpackers.

What have they done? Something pretty impressive. They have performed, amongst other things, global image classification using machine learning on training datasets of steel, cement, abottoir, petrochemicals, paper/pulp and waste management plants. This has resulted in location datasets of previously uncaptured sites of assets. This complements open source data on carbon intensive manufacturing plan locations such as from OSM or produced by manual tagging with a crowdsourcing approach (reminds me of Appen).

An example of a spatial analysis performed with these datasets was to intersect these assets with a water stress raster. If water supply is restricted where a cement plant is running, for example, this gives insight on likely reliability of operations and associated costs of addressing this. Given this data allows us to make associations with stock tickers, suddenly we have a useful new data stream to consider along with traditional fundamental analysis using the balance sheet, income and cash flow statements.

In addition to maintenance costs we can use location information of manufacturing assets to gauge production. Earlier on in the same video there is another New Zealander from Transition Zero who spoke about using heat detected by satellites as a proxy for steel plant production. They found only a 10% error rate in this method:

Trader Spatial Finance

Now we are on to the way that Synmax uses satellite imagery. They also use it to gauge production rates, this time in oilfields with their Hyperion product. Exactly the same kind of prediction by Synmax is spoken of here:

They found within 0.1BCF/day mean absolute error. So, it’s taken a bit - sorry for the longer post than usual - but I think we have, pardon the pun, been productive here as we have a couple of examples from different teams in different parts of the world using geospatial analysis to estimate production. Both claim to be practicing spatial finance. Both use spatial analysis to inform decisions about publicly traded instruments.

Who is Bill Perkins?

And it seems to work. In addition to founding Synmax and Skyfi, Bill Perkins runs energy trading firm Skylar Capital. This firm made a 208% gain in 2022. It bears looking into his career a little more. It provides a fantastic contrast to the aforementioned FinGeo academic who couldn’t bring herself to refer to people like Bill as anything other than a practitioner. Who, going by the ideologies evident in the call she was moderating about financial geography, has spent her life devoted to social justice. Whose colleagues would never have experienced, and would be repelled by, the hedonistic excesses permitted by Bill’s success as a natural gas trader.

The contrasts here are truly salivating, evidenced in the starkest fashion by Bill’s many posts with the king of Instagram, Dan Bilzerian:

Dan Bilzerian is popularly thought of as a successful poker player who won millions and spent it on partying, girls and jets. Vice, on the other hand, suspects his father bankrolled his life as a way to avoid paying fines to the SEC. Legal issues in Dan’s life include:

Suing the producers of Lone Survivor for not being given enough screen time or dialog.

Being banned from a nightclub for kicking a woman in the face after she fell during a brawl.

Refusing to pay compensation to a porn actress he tried to throw off a roof into a pool. She hit the edge and broke her foot. This was part of a photoshoot for Hustler, who also refused to compensate her, referring to Dan’s poor throwing ability as an act of god.

Being arrested at LAX for bomb making in Nevada.

It pains me to say it, but: Bill Perkins has somehow found the patience to hang out with this guy, a lot. In a further clear sign of their camaraderie, Dan and Bill have placed bets against each other. An example of this additionally serves as a nice illustration of Dan’s apparent incapacity for true achievement. Dan cheated on a 300 mile bike ride bet with Bill. He did this by drafting behind a van for the first 200 miles. This basically means Dan only rode 100 miles as the van effectively sucked him along the road. I can tell you based on my own experience that this was unnecessary.

I have done some real rides, such as 6,500km over 89 days from Bulgaria to DC in 2018, Towards the end I was routinely doing 200km a day. It took 3 months of gradual increases starting at 75km a day. By the end I was feeling fresh after a 10hr, 200km ride. Admittedly, this is less than half of 300 miles. Nevertheless I can say it would be possible to double the distance I did - that would be basically 24hrs straight riding though at the pace I kept. Sleep would be the issue here, you’d have to address this by riding faster. So give it 4 months of training and I think you’d have a decent shot at 300 miles in 24hrs. What did Dan choose to do instead? Avoid the true challenge and draft behind a van.

A touch of controversy appears to have accompanied Bill’s life from early on. A Spear’s profile states that he made a fortune trading natural gas over a 12 year career. I began to develop a suspicion that he traded for Enron noting from that article that he went to Texas to run a derivatives/options desk in 1995. That is the year John Arnold joined Enron as a 21 year old and he stayed there until it collapsed. Wikipedia states that, after graduating, Bill worked under John ‘for several years’. That does not definitively mean he worked at Enron, but it isn’t ruled out. What is clear across multiple sources is that after Enron collapsed, Bill joined John in starting Centaurus. The FT states Bill did not work for Enron. On the other hand, when a host on the HC Insider podcast introduced Bill as, amongst other things, having worked for Enron, he was not corrected. He was also not corrected when, during the podcast, he was referred to as an alumnus of Enron:

At this point I feel like I may come across as trying to cast Bill Perkins in a bad light. I have after all spent paragraphs noting Bill’s associations with the world’s most preposterous Instagram stooge, Dan Bilzerian, and the world’s most notorious corporate fraud case, Enron. Perhaps we can step back a bit and properly survey the scene of how genuinely high flying Bill is. For example, he made 4 ok movies a decade ago, then becoming a poker player, with more than $5M in winnings so far.

If you search for him on YouTube you get a pretty good impression of how far he has risen in the eyes of the average guy who wants to have fun. He regularly appears on CNBC commenting on natural gas. The best one I found was him being interviewed from a yacht, with the horizon pitching in the background through the window!

Then there is this gratuitous profile by UNILAD:

He’s of course written a book, the subject of his most recent profile, this time by a Brit:

The book is about the provocative idea of living life to the fullest, even if it involves taking on debt. Bill is not a fan of saving money when it amounts to self punishment. He encourages people not to suffer through the grind if it ends up being meaningless. For example, a conservative saver may lose their taste for adventure. They mightn’t actually get the reap the rewards, such as by eventually spending money they’ve saved on something memorable.

Best way I can describe this is it’s the sort of philosophy that one might expect to emerge from someone who made a billion in natural gas trading profits. I don’t begrudge him those gains. I also can see how someone who has not made such a fortune may have a different attitude about saving and delaying gratification. Bill appears to face a different set of consequences for failing to save money than someone who is poor and lacks the intellect, confidence and education to making a killing as a trader.

Now, this isn’t to say Bill is indifferent to the lives of those who are less fortunate. We can now return to the episode about Synmax with Eric. I was really taken by what Eric said about Bill’s efforts to use analysis of satellite imagery to assist the coast guards of impoverished African nations trying to fight off Chinese dark fishing fleets. Yes, there is clear evidence of unimaginable hedonism in Bill’s life. Similar to superheroes like Tony Stark or Batman, however, he also shows evidence of a sense of justice. The effect, according to journalist Ian Urbina, is ‘that there is nowhere to hide anymore in the world’s oceans’:

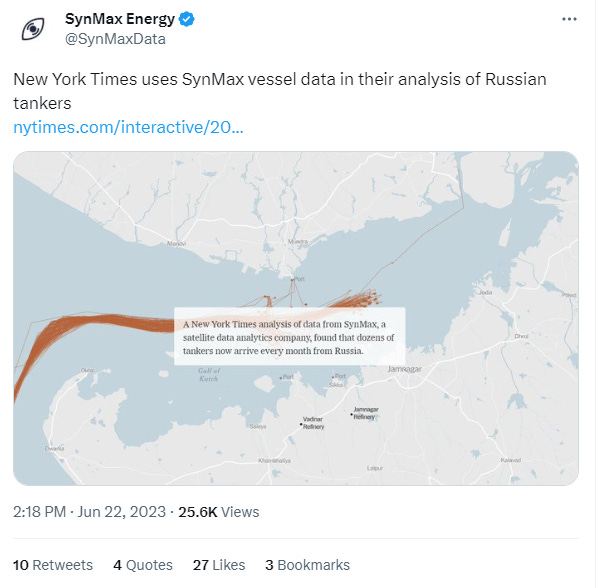

Even the NYT is using Synmax data for tracking dark Russian tankers:

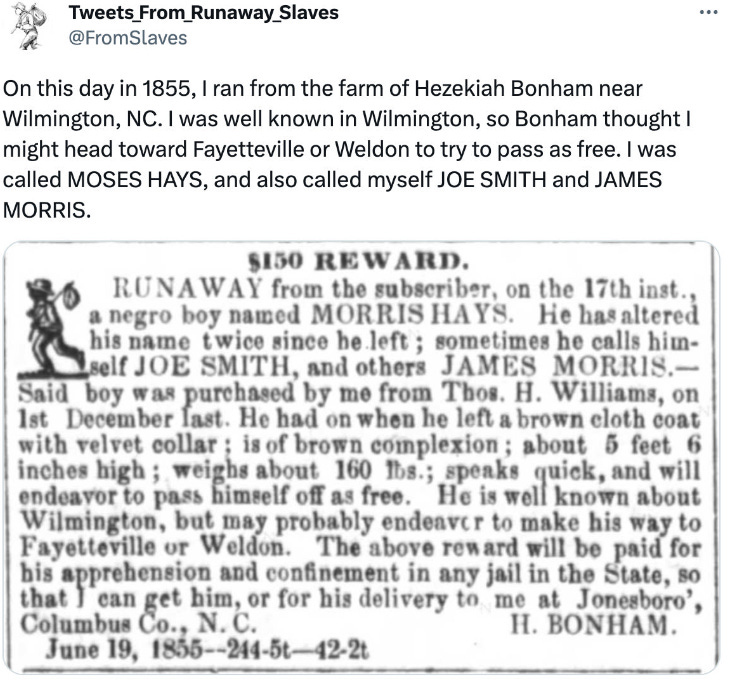

Another amazing initiative of Bill’s is Runaway Project, associated with Cornell’s Freedom on the Move. This involved setting AI/ML capable staff from his organisations, including Eric, on the task of describing African American history via thousands of old runaway slave newspaper ads. I just love the way their stories are reconstructed in a humanised fashion from the terse words of the ad:

Figure 3. Supercluster.com, Machine Learning Reveals Hidden History of Runaway Slaves

This also helps explain this video from Eric’s YouTube channel:

As such, we are confronted with a rare real life example of a young boy’s dream life. Heroic acts, ridiculous bets, appearing on TV, directing movies, drowning in attention… Interestingly this type of character appears to be a dying breed in finance, see the WSJ. Perhaps it is because of outcomes for others of this type such as Crispin Odey. The FT published a harrowing account of this star financier early June, detailing his decades long sexual abuse of women, young and old, colleagues and acquaintances. A follow up article details how the first article resulted in a run on his funds. This is not at all to say Bill is guilty of the same, but only to illustrate the risks of success that others have not been so successful in mitigating.

Conclusion

We can bring things full circle here by noting the final piece of advice Eric gives to apprentices. Intellectual humility - ‘if you develop hubris, you develop blindness’:

I will leave it to the reader to consider how the characters introduced in this piece stack up on this dimension.

Tying up a couple of loose ends from the episode, Eric mentioned Synmax is in the process of acquiring Gas Vista. They have a nice map animation of ships they track, a function Eric said Synmax will integrate into their offering. Where to next? Well, Gabe gave me a SAR image of London in the last episode. Unfortunately it wasn't autographed by Joe Morrison, maybe Luke Fischer didn't ask for one on my behalf after all (check the Skyfi interview for the reference!) But I feel something is building here if I do my homework.

Additionally, needless to say, I have reached out to businesses profiled in the conferences run by the academic version of spatial finance. So far transitionzero.org and globalenergymonitor.org have come back to me saying they’re interested. So looking forward to keeping this investigation going with them!

So that was my best shot at a truly comprehensive Spatial Finance State and Trends Report. As opposed to the far more bland rendition from Oxford, who missed all the Instagram stuff. To think that in a few short years spatial finance as a field has amassed such a rich history, connected to some of the most controversial figures in the popular consciousness (well, one, but please play along). It’s surely up there amongst the more notorious fields in science already. I’m definitely keen to keep profiling it and even more enthusiastic about becoming a practitioner. So long as I can adhere to Eric’s advice for apprentices.

THE GEOSPATIAL INDEX

The Geospatial Index is a comprehensive listing of all publicly traded geospatial businesses worldwide. Why? The industry is growing at ~13.8% annually. For only $11,600 to start, this growth rate is $5,000,000 over a working life.

This channel, Twitter account, blog, watchlist and podcast express the view that you are serious about geospatial if you take the view of an investor, venture capitalist or entrepreneur.

You are expected to do your own research. This is not a replacement for that. This is not investment advice. Consider it entertainment.

Watchlist: https://www.tradingview.com/watchlists/19805134

Podcast: https://podcasters.spotify.com/pod/show/geospatialindex

Blog:

Meetup: https://www.meetup.com/london-mapup

NOT THE OPINION OF MY EMPLOYER

NOT YOUR FIDUCIARY

NOT INVESTMENT ADVICE

Share this post