NOT THE OPINION OF MY EMPLOYER

NOT YOUR FIDUCIARY

NOT INVESTMENT ADVICE

Will Cadell is the force of nature leading SparkGeo. Join us as he takes us through the reasons why the latest crop of earth observation SPACs have gone south. This is something he has already written about:

He references another great Substack piece containing a framework for analysing these companies:

The contention here is that some babies have been thrown out with the bathwater. That’s not really Will’s point though, and he’s expanded on it already in a follow up post to this interview:

Overall, Will’s view is that “What is missing is the analytic bridge between pixels and products.” He expands more on developments in the past decade that now make this possible here:

My take is that we need a commoditised geospatial analytics solution. At the moment it is all far too artisanal. We need an analytics-under-a-button type solution for the vertical(s) a company is trying to sell into. Say for corn farmers in southern France. There might be a bronze, silver and gold tier in a web based, geospatial analytics software subscription they can buy. The bronze tier gets 5 buttons on their dashboard. Silver has 10 buttons. Gold gets 15. Each button does an analysis to help them run their corn farm better.

Commoditisation on many fronts enables this. As Will said in the interview and in the above Twitter thread, cloud computing has caused computing and storage to now be commoditised. The rash of “New Space” earth observation companies mean we have a plethora of public and private constellations floating above us. Thus, earth observation has become commoditised also.

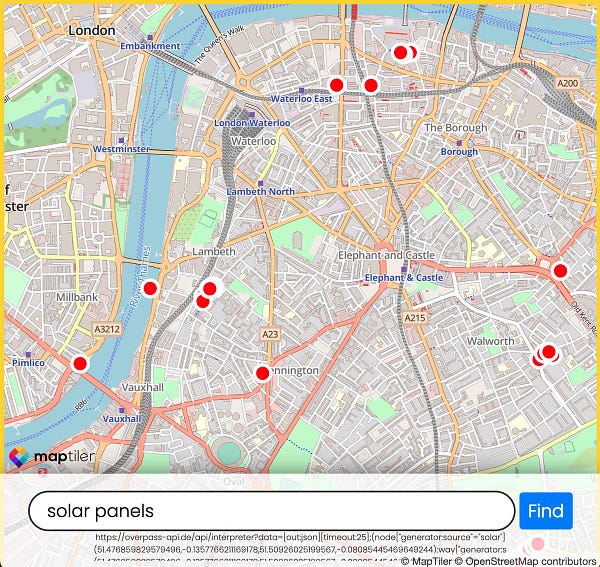

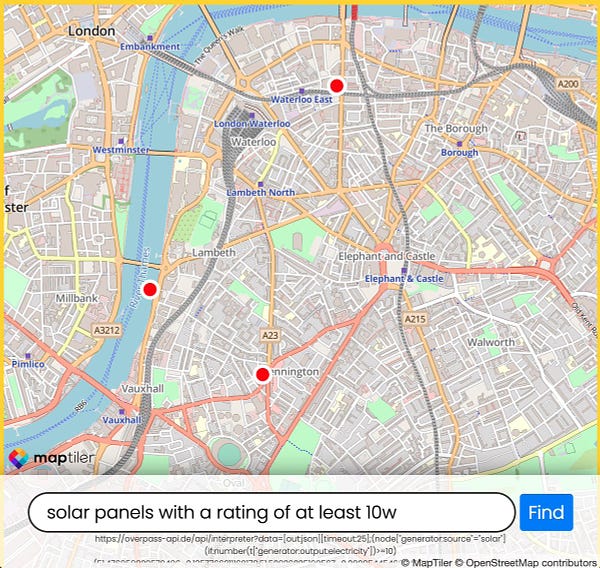

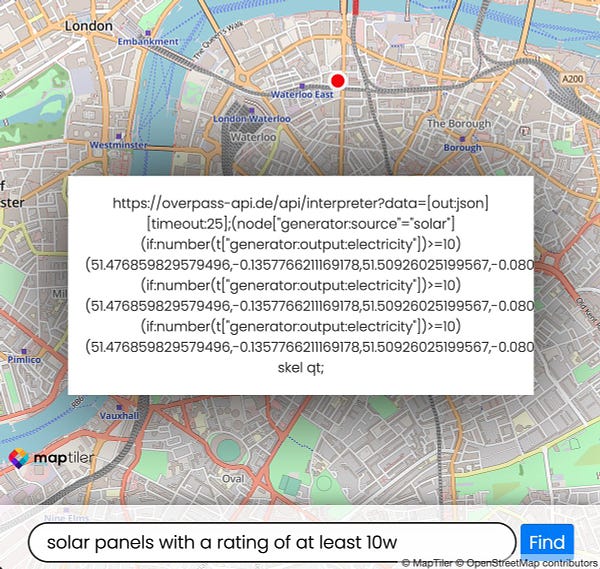

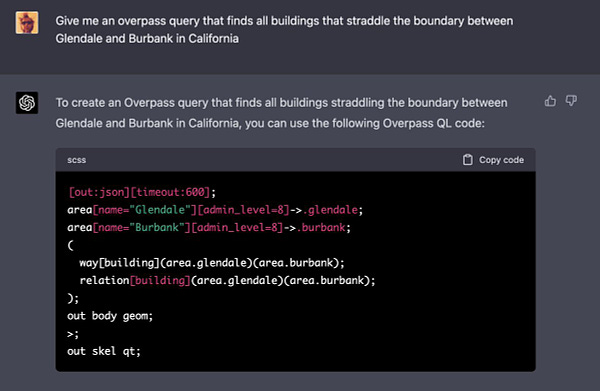

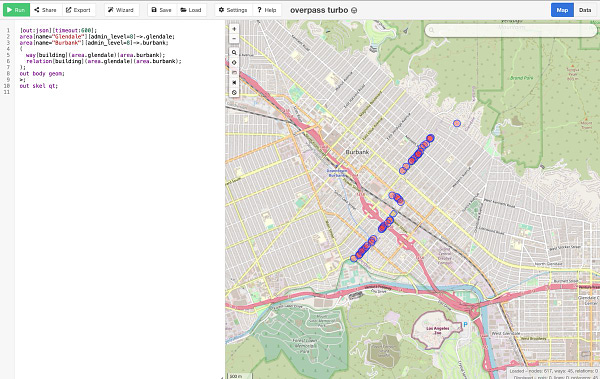

The final piece of the puzzle is coming into place with the emergence of generative AI. Geospatial examples of this are:

What Steve Attewell at Ordnance Survey has achieved:

What Marios Kyriakou has achieved with QChatGPT:

John Wiseman describes doing a similar thing in Overpass Turbo with GPT4:

Yes, of course I have reached out to most of these people for podcast episodes. Stay tuned to see who comes on!

So what is my point? Well, commoditisation of analysis seems more manageable in the context of generative AI. It seems to have taken about a decade for cloud computing and storage to become ubiquitous. I can’t see why another decade won’t show the puzzle being complete. I expect by then for example corn farmers in the south of France, growing a particular species of corn unique to that climate, will all have some form of geospatial software subscription. I expect it will give them answers about where and when to till the fields, plant their crops and what irrigation regime to use, plus another couple of analyses for the bronze tier. I expect this to function based on up to the minute, commoditised earth observation data from a special constellation dedicated to precision agriculture. I expect it to also function on commoditised computing and storage enabled over a distributed spatial computing architecture/‘the cloud’. Finally, it will be enabled through commoditised intelligence/‘AI’.

Will’s message is an inspiration for a less technologically showy kind of business. It won’t be able to lay claim to an awe-inspiring, promptly taskable constellation of nanosats. What it will be able to lay claim to, however, if executed well, is a revenue stream from the pixels they bombard us with down here on earth. A revenue stream that these constellations do not appear to have impressed the market with thus far.

Let’s check back in a decade to see who has heeded this call to action.

Thanks again Will for an inspiring chat and being gracious enough to spend 40 minutes with an aspiring new geospatial podcaster who had the hide to send him a message on Twitter.

THE GEOSPATIAL INDEX

The Geospatial Index is a comprehensive listing of all publicly traded geospatial businesses worldwide. Why? The industry is growing at ~13.8% annually. For only $11,600 to start, this growth rate is $5,000,000 over a working life.

This channel, Twitter account, blog, portfolio and podcast express the view that you are serious about geospatial if you take the view of an investor, venture capitalist or entrepreneur. You are expected to do your own research. This is not a replacement for that. This is not investment advice. Consider it entertainment.

Twitter: https://twitter.com/geospatialindex

Watchlist: https://www.tradingview.com/watchlists/19805134/

Podcast: https://podcasters.spotify.com/pod/show/geospatialindex

Blog: https://www.geospatial.money/

NOT THE OPINION OF MY EMPLOYER

NOT YOUR FIDUCIARY

NOT INVESTMENT ADVICE

Share this post