Compounding

A=P(1 + r/n)^nt

P = principal balance,

r = interest rate

n = number of times interest is compounded per year

t = number of years

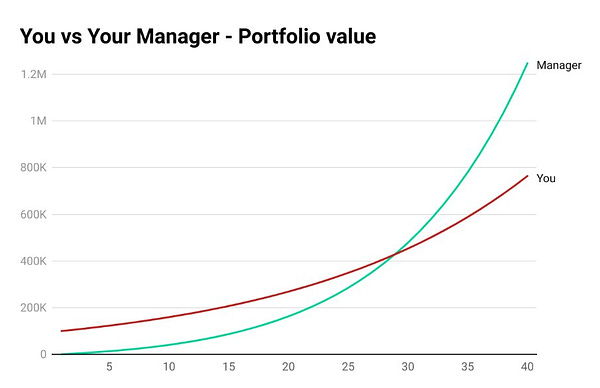

Frequently people have the above compounding formula working against them. For example, banks like to do this via credit cards, loans and mortgages. Consider a $100,000 mortgage at 5% interest over 30 years. This in fact involves paying the bank back $193,256. A more insidious version is hedge fund managers:

How galling to think that someone sitting there managing your money makes more than you do despite you being the one to risk your money with them. Suffice to say that the common person is comprehensively stitched up by financial institutions and money managers using the formula that started this blog.

Common people do not leverage this formula for themselves.

Let us look at this in one more form:

This gives us an insight into how to use compounding in our lives. At least in addition to working hard, getting a qualification, getting a chartership, sweating over continuous training to keep up with your profession, not to mention actually working… there is another way to generate a return.

And here’s the funny (and sad) part.

I work in the geospatial industry. Maps. Surveying. Databases. GPS. You get the picture. What’s funny and sad about this? There are at least 159 geospatial businesses on stock markets around the world. They’re in these sectors and industries:

Following the above quote, an investor could buy shares in those businesses, once, when you start your career. The investor could then sit there for your entire career doing nothing. You’re sweating by studying, then working. They’re relaxing.

And they could beat you, or at least keep up, through compounding. Compounding in the very industry from which you are earning a salary. A salary which only grows in a linear manner. Not an exponential one. Why? Since I started my career in 2011, these businesses have compounded at 13.8% annually. A working life is 65-18=47 years. One might expect to earn about $5,000,000 in total over one’s geospatial career. To gain this much by compounding, what is required for the principal balance (P) in the compounding formula above? Only $11,600:

That’s right. An investor could get the same outcome as you, as a worker in the geospatial industry, with just over 10 grand compounded at 13.8%. All they need to do is buy an equal $ amount of shares in each geospatial business. Then sit there for 47 years watching Netflix.

To them, your lifetime output can be bought for $11,600. But you would cost more than that. They would need to feed you and house you. So it would be better to be an investor. And we all know your education costs to learn the skills to earn that salary would cost more than they have to put down initially. Plus they get a head start as they get to start compounding right away. You have to spend half a decade first at university earning nothing.

So your entire career can be replaced by a lazy investor with 10 grand.

This is why I started The Geospatial Index.

We Can Help Each Other

I’ve made a good start on how to capture the value in geospatial that is usually the province of venture capitalists, investors and entrepreneurs. This is documented in a couple of posts on Geoawesomeness. As detailed in the second post there, I have scoured the world and, as of 2023-02-05, am up to 159 companies in this Index.

I can’t do this alone though. For example, I live in London, and speak English. I have made a start finding Chinese, Japanese, Korean and Indian companies but would have only scratched the surface. A bigger issue is dead companies. These 159 firms are currently operating. They are the survivors. Hence the term ‘survivorship bias’. We cannot conclude that the growth rate of this group of businesses represents that of the industry.

Well, I am actually relatively confident that the past 10 years is ok. My index shows a third of them are in the red. One of them, Maptelligent, went bankrupt in 2020. The Index now owns no shares in an additional 11. An example of how complicated it can get is Mobileye. This entered the Index 2014 upon IPO on the NYSE. It left in 2017 when acquired by Intel. Intel, however, has since spun it off again in 2022. So it is back in the index but this time traded on the NASDAQ! Another notable one that’s left the index is Nearmap. This compounded heroically at 50% per annum for a decade from 2012 before private equity got it. A tragedy for the investing public.

So I think I have an index relatively free of survivorship bias for the past decade but prior to that this is not the case. I have live positions going back to 1962. This is for IBM - responsible for the first ever GIS:

The majority of geospatial, and related, businesses will have been acquired or gone bankrupt since then though. It’s really hard to find the ones that died from so long ago. What’s even harder is to find out the stock price history of such firms. Why does this matter? Well, if we’re going to build an index, this necessitates buying shares in every business. We have to be prepared for a significant proportion going south.

So I need help. For the geospatial stocks outside the Anglosphere, and the dead stocks. Together we will build a valid, global impression of the compounding rate of our industry. This will enable us to profit from it beyond our salaries.

A Community

To make this appeal work, I am running London Mapup. This a way for us to meet in person. It will be at German Gymnasium from 6pm, the second Thursday each month. Further details on Meetup. Do spread the word. We’ll also use the chat function on the Substack app to keep in touch. And I’m on Twitter:

On Twitter I also started a list of all Geospatial Index companies that are on the platform:

And because podcasts are so useful I also made another list of all accounts related to geospatial podcasts.

What’s Going to Happen?

Free subscribers can come here for the podcast and general updates on additions to the index. Paid subscribers get an depth analysis monthly of a publicly traded geospatial business. This will be done using a framework taught by Professor Kenneth Jeffrey Marshall of Stanford and the Stockholm School of Business. I learnt value investing under him in 2019. Such reports generally take at least 6hrs to produce. I have a systematic, data-driven, fundamentals and check list based approach. That was a mouthful. The reports generally run at least 15 pages. They are the result of a thoughtful process which comfortably puts us beyond the reach of gambling urges and emotional overrides that dominate a lot of market behaviour. More on behaviour management at my other Substack.

Index Rules

There is also the index itself. This will be tracked for all to see. It will be incredibly basic in approach:

Buy any geospatial IPO/SPAC

Buy any geospatial spin off

Buy any non pure-play geospatial company that nevertheless acquires a geospatial company or sells a geospatial product/service that impacts the industry (classic case being Google)

Sell when a non pure-play geospatial company divests its geospatial component (classic case being Pitney Bowes selling MapInfo to Precisely)

The index is equal weighted, each position is worth $AUD100 to start (because that’s where I’m from)

Never sell

The only way something exits the index is bankruptcy, if it is acquired or if a non pure-play business divests its geospatial branch. In that case, the divested part is purchased if it is publicly traded. Again, this can get complicated. Continuing the MapInfo example, Precisely bought it off Pitney Bowes. Precisely is not a pure-play geospatial firm. Nevertheless this transaction resulted in them going into the Index and Pitney Bowes leaving. This is because MapInfo, the ball being tossed around, hugely impacts the geospatial industry.

Putting My Money Where My Mouth Is

Finally, I will be putting my money where my mouth is. Last month I opened an Interactive Brokers Stocks and Shares Individual Savings Account (ISA). You can benefit from up to $USD1,000 in shares of their stock if you use my affiliate link. ISAs are important to take advantage of if you’re in the UK. Why? Capital gains and dividends aren’t taxed!

Subscribe

Needless to say, please subscribe so you don’t have to do anything (remind you of someone?) but wait for each post to be delivered by email.

Step by step we can index this space and benefit together from compound growth. Our discipline even serves up a number of options for indexing strategies!

“Typical space filling curves” in Zhou, Wang, Zhou, Sin, Zhao and Meng (2021).

Reference

Zhou X, Wang X, Zhou Y, Lin Q, Zhao J, Meng X. RSIMS: Large-Scale Heterogeneous Remote Sensing Images Management System. Remote Sensing. 2021; 13(9):1815. https://doi.org/10.3390/rs13091815