This is not investment advice.

I am not your fiduciary.

This is not the opinion of my employer.

Introduction

Outdoor GPS devices from BG T&A.

BG T&A hit The Geospatial Index because around 2019 they developed a smartwatch and other devices for navigation on golf courses. They are an original design manufacturer: "a company that designs and manufactures a product that is eventually rebranded by another firm for sale." - Wikipedia. Escort and Cobra sell their products in the US. Another reason for them being in the index is that some of the dashcams, such as the Cobra SC 400D, allow trip planning and turn by turn directions on the display. This one also happens to have been PC World’s Editor’s Choice for dashcams in 2021.

So let’s have a look at how a small (market cap $USD67M) navigation device manufacturer fairs against our framework.

Metadata

If you want to view this as a Google doc, click here. I have a Google sheet that spits these out using a handy extension called Document Studio.

KOSDAQ:046310

Date of Analysis (MM/DD/YYYY): 6/7/2023.

Date of financials (MM/DD/YYYY): 12/31/2022. Note that this may be a historical report and financials may be from years ago.

Idea source: Small cap, Stock screener, (50M or fewer shares).

Analysis date price: KRW3,315.000.

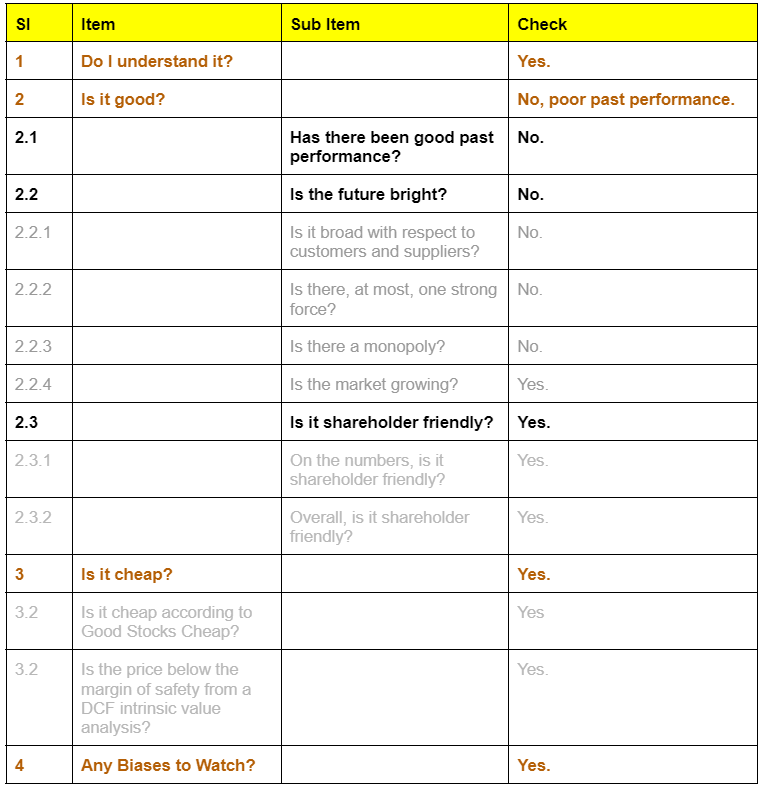

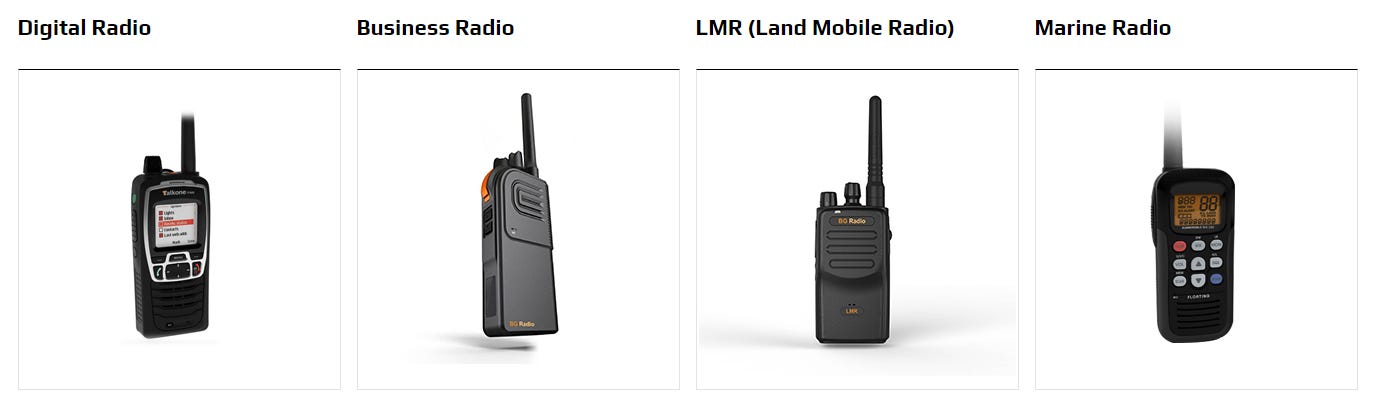

Framework outcomes

Good Stocks Cheap: The price is cheap and, remaining so, can still move up 30% to KRW4300.

Growth With Value: The price is cheap and, remaining so, can still move up 198% to KRW9889.81.

Verdict: Don't Buy, Checklist:

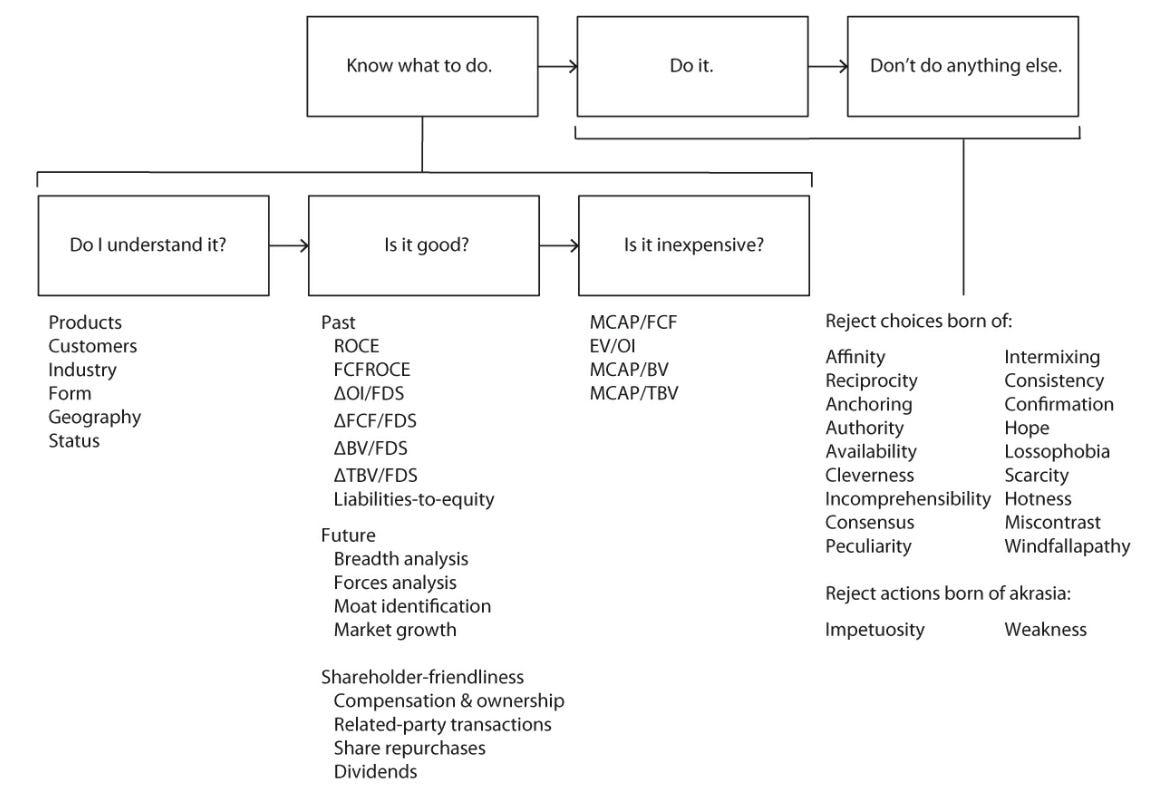

Framework

Marshall (2017), p. 188.

Do I Understand It? Yes:

Understanding Statement

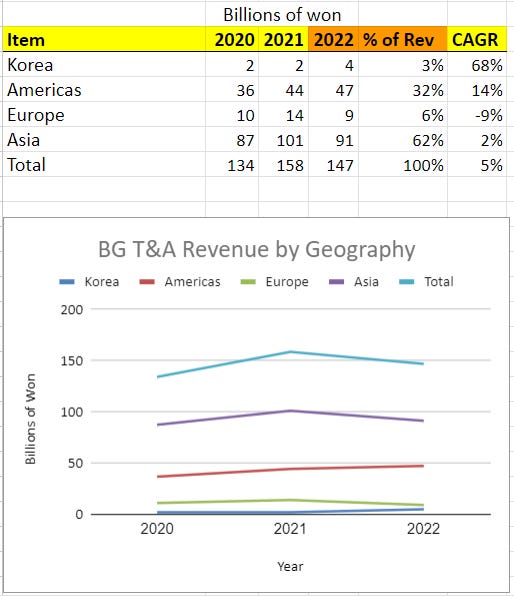

BG T&A is an original design manufacturer of dash cams/radar detector and dashcam combination (58% of revenue), radar detectors (23%), and walkie talkies (18%) in Asia (62%), Americas (32%), Europe (6%) and Korea (3%), they have 50% of the US radar detector market and are mitigating the impact of the US China trade war with Philippines manufacturing, their fastest growing geography is the Americas (14% CAGR) and fastest growing product is dashcam/radar detector combo (15%).

Is it Good? No, poor past performance:

To determine if BG T&A Co is good, it was analysed from three perspectives:

Past performance, to see if they’ve been good stewards of their capital.

If the company’s future is bright, considering breadth, forces, monopolies and market.

If the company is shareholder friendly, such as whether leaders behave like owners.

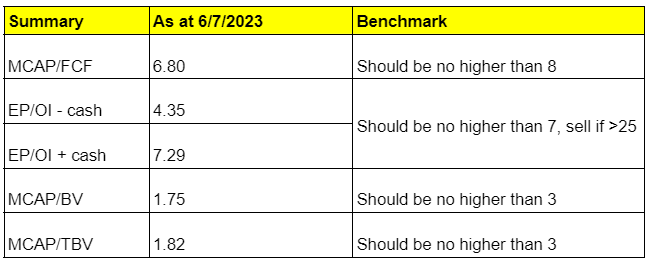

1. Does BG T&A Co Have Good Average Past Performance? No:

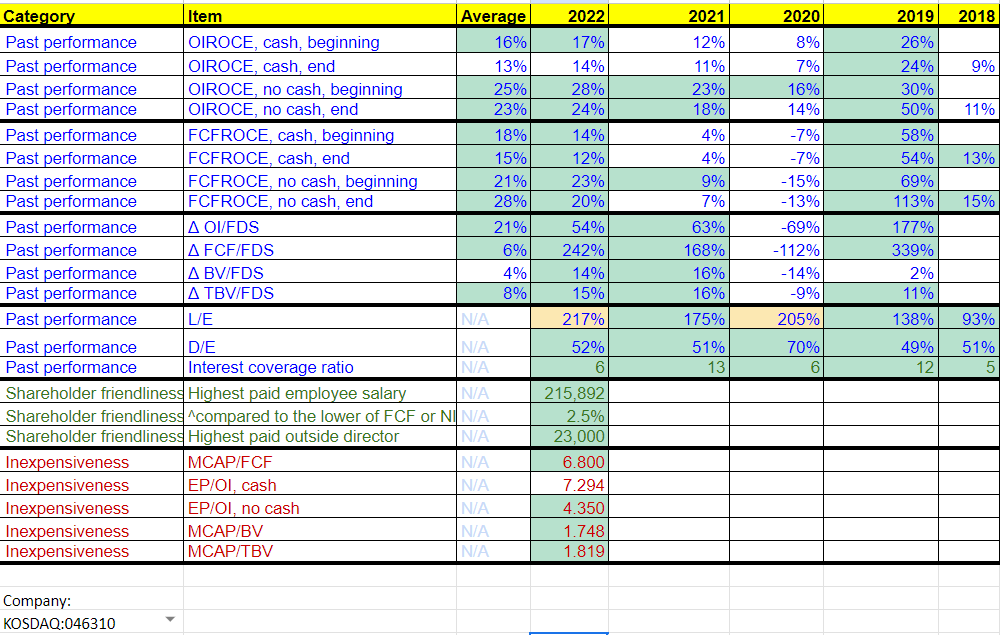

Judgement of past performance is based on averages over the past however many periods the analyst chooses to input. Was the performance in the most recent period good? No. Further detail by year is available in the next table.

Past performance comments

Goodwill was subtracted as it is identical throughout the period analysed, indicating acquisitions are not part of generating revenue. It was so small it had no noticeable impact anyway. Whilst it is automatically assessed as not showing good past performance, in reality the averages over the past 5 years are all fine. Sure, one of the OIROCE averages is below 15% but the rest aren’t. Sure, BV growth is just shy of 4% but it’s near enough and rounds up to 4.

Income comments

There are no securities convertible to common stock billable securities, so there is no dilution effect. Therefore, diluted earnings per share equals basic earnings per share.

Balance sheet comments

Made liberal use of Tradingview financials to help interpret the Google Translated Korean financials. Current portion of loans payable is comprised of translated items "(2) Short -term other debt, (3) Short -term car deposit and (6) liquid lease debt", the first item, worth KRW578,196,038 in 2022, does not appear in the Tradingview financials, so that's why my number is higher than theirs. For long term debt again my number is different as I am summing the translated items "(2) Long -term car deposit, (3) lease debt and (5) Provided debt"... Tradingview does not include the latter item, worth KRW341,373,694 in 2022.

I note there is a dramatic amount of equity against noncontrolling interests.

Cashflow comments

Maintenance capex was taken as depreciation. Depreciation is not found in the financials tables. I found it in a table called 'Classification of Expenses by Nature", but really by searching the annual report PDFs for "Classification by nature of cost is as follows." I summed the items "depreciation" and "Depreciation - right-of-use assets", these came relatively close to depreciation and amortization in Tradingview.

2. Does BG T&A Co Have a Bright Future? No:

Does BG T&A Co Have Enough Breadth? No:

Does this company have breadth of customers? No:

4 customers accounting for more than 10% of revenue in total are responsible for 132,274,874,184, 90% of revenue. This means at least 1 of those customers accounts for more than 20% of revenue and we should proceed with caution.

Does this company have breadth of suppliers? Yes:

They have good discussion of the situation on supply of raw materials on page 11: "the main raw materials are semiconductors such as MCU, printed circuit boards, passive elements such as MLCC, and various electronic parts such as batteries and power supplies used in composing and manufacturing products." They advise crises such as Ukraine war, China US trade war and COVID have not yet been recovered from in terms of securing supply of raw materials. Next crisis is interest rate rises to contain inflation brought on by excessive currency liquidity: "have led to the cancellation of the accumulated order backlog as most manufacturers began to hedge the risk of excessive stocks held due to supply problems for a long time." No issues with specific suppliers are mentioned. Raw materials suppliers are surely in plentiful in the region they operate.

Escort is a one of their two main US customers.

Does BG T&A Co Confront Maximum 1 Strong Force? No:

The number of strong forces this company confronts is 2. To consider it further, there should not be more than 1.

The bargaining power of customers is Strong:

Number of customers: There are 4 customers accounting for 90% of sales.

Improbability of backward integration: The point of being an original design manufacturer is that the brands requesting widgets from you don't know how, and you have all the patents.

Switching costs: Customers seeking your white label devices will incur switching costs due to you owning patents.

Summary: Especially for radar detectors and the new emerging combined dashcam and radar detector device they are going to cause switching costs for their customers if going to another original design manufacturer. There is a reason probably that they have 50% of US market and are Motorola's largest supplier for walkie talkies. On the other hand, there is no getting around the fact that there are 4 customers accounting for 90% of sales, meaning at least one customer has more than 20% of their sales. Hence bargaining power of customers is strong.

The bargaining power of suppliers is Weak:

Number of suppliers: Unknown

Improbability of forward integration: Unlikely basic battery and semiconductor suppliers will start making their own devices.

Switching costs: Low

Summary: Low because there are so many of them and they're unlikely to forward integrate.

The threat of substitutes is Strong:

Wholly different products that perform the same basic function: Waze and other navigation apps that use crowdsourcing can do a good job of replacing radar detectors, if people bother to report ones they observe.

Doing without: The need for walkie talkies, radar detectors and dashcams have been around for decades. It seems basic radar detectors are finally going out of fashion in Japan, but they are moving into Europe and shifting to a combined device with modern functions such as smartphone integration.

Direct substitutes:

Radar detector/dashcam combo

Cobra and Escort appear to be popular combo devices for the US. BG T&A's annual report states that they supply the products for both brands. Example of BG T&A's leading product is the Cobra Road Scout, combining radar detector and dashcam. It's USD380. The Escort MAXcam 360c is twice the price. Interestingly, both Cobra and Escort highlight a community of drivers as a differentiating factor, where people share locations of speed traps with each other. This must be because BG T&A have sold the same overall solution to both brands. Escort also sell a dashcam designed to bolt onto their radar detector. It's USD150.

Radar Detector

As shown here on this Amazon search ordered by best rated products, Cobra is second on the list, Uniden is first and Escort is further down the page. Uniden appears to dominate the best ranked products. Uniden devices are solely selected by Amazon in their list of highly rated, best priced products.

Walkie Talkies

On Amazon there are about 20 brands. This link sorts by best reviews and shows Moico is the winner then Pxton, Retevis, WisHouse, Rivins... all brands I've never heard of. Motorola and Cobra are nowhere on the first page of these results, only on the second page. This indicates BG T&A is not selling the best reviewed walkie talkies on Amazon.

Summary: BG T&A, via Cobra and Escort, is not a clear winner in any category based on Amazon searches ranked by rating. They simply are a competitor in each of radar detector, radar detector with dash cam combo, dash cam and walkie talkie markets. As such, threat of substitutes is strong.

The threat of new entrants is Weak:

Barriers to entry; barriers to success: The barrier to entry is not high but barrier to success is patenting unique devices. BG T&A have some patents but nothing recent. The earliest is 2000, latest 2014 (antenna for radar detector in US and Russia) on p. 22 of annual report..

Economies of scale: They state "Radar Detector (RD) We have cost competitiveness by achieving economies of scale by producing 400,000 to 600,000 units per year." They do emphasise Chinese manufacturers as a strong competitor due to lower cost of production and their catching up with their own R&D as the country's education standards improve. On the other hand, US trade conditions mean that it may be harder for these competitors in the US. BG T&A will not fall afoul of trade sanctions/tariffs as they manufacture in the Philippines.

Higher switching costs: The new entrant is likely to have higher manufacturing costs due to BG T&A's scale of operations, for example serving half the US market for radar detectors and being Motorola's largest walkie talkie supplier.

Hard-to-get permits: Nil

Summary: BG T&A are a high volume supplier and can defend themselves with the associated cost advantages.

Does BG T&A Co Have a Monopoly? No:

Government: No.

Network: No.

Cost: No.

Brand: No.

Switching costs: No.

Ingrainedness: No.

Market Growing? Yes:

I have the following summary from the latest annual report.

Radar detector

The US accounts for a third of the global radar detector market and they have a 50% market share in the US. Japanese market is rapidly declining. They claim have cost competitiveness by achieving economies of scale by producing 400,000 to 600,000 units per year. As a strategic partner with the number 1 distributors such as Cobra and Escort in the US, they have market dominance through steady transactions.

Walkie talkie

Motorola has 50% market share and account for the highest sales among Motorola Solutions outsourcing companies.

Dashcam

Mature domestic market, but growth in Europe and global market growth 13% expected.

Combined RDDC

Early stages, growth market. No information on dominance/growth but one can see in the chart at the beginning of this report that the CAGR is good.

Cobra is one of their main US customers.

3. Is BG T&A Co Shareholder Friendly? Yes:

Friendly on the Numbers? Yes:

The CEO’s salary is KRW215,892,000 per year. This is 2.47% of the lower of free cash flow or net income. The highest paid outside director gets KRW23,000,000 a year. On the numbers, is this a shareholder friendly company? Yes.

Ownership and material insider buying at market

The vice chairman and executive director Lim Hak-gyu owns 3,918,405 shares. This is 26% of the company. I am not able to find information on insider purchases recently in annual report. Perhaps a Korean stock broker can help?

Share repurchases

A search of the annual report for repurchase returns nothing. In a table about acquisition of treasury stock on p. 7, the table is empty. The same goes on every annual report back to 2018. Seems that the way they pay shareholders is through dividends.

Related party transactions

There is a lot of detail on related party transactions in the annual report but they are actually listed as subsidiaries in the tables on this section. All seems relatively benign, it's just a record of sales to subsidiaries. On the more suspect side, there is a record of a short term loan of KRW300M (USD232K) at 2.6% and "As of December 31, 2018, certain borrowings and contracts of the company are provided with payment guarantees of KRW 22,882 million from the CEO."

Dividends

No dividends have been paid since 2020. Prior to that they state 11 consecutive dividend payments. They report an average dividend yield of 0.7% over past 5 years.

Shareholder Friendly Overall? Yes:

There is significant insider ownership of ~25%. Executives and directors are paid small sums. No one in the company is paid more than KRW500M (USD388K). They appear to have cancelled what was a steady dividend probably due to combined shocks of trade war, COVID and now Russia/Ukraine conflict and inflation. There are some issues with related party transactions but no signs of private jets at least. Overall benign.

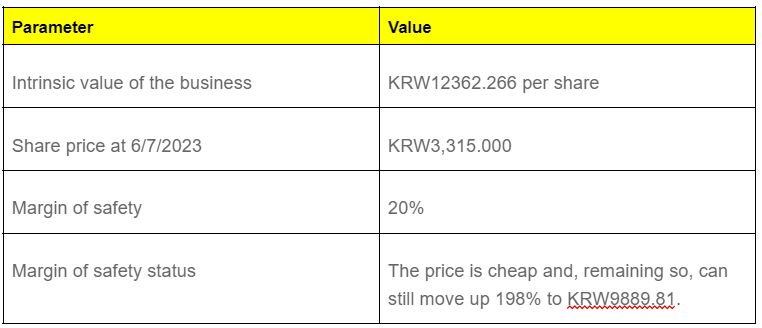

Is it Cheap? Yes:

Analysis date price: KRW3,315.000, cheap price: KRW4,300.00. The price is cheap and, remaining so, can still move up 30% to KRW4300.

Discount Cash Flow Analysis

A discount cash flow analysis (DCF) is mentioned as a common method in How to Value a Business (Cowley, 2019). The below DCF has High Growth Period and Terminal or Stable Growth Period segments. The intrinsic values of each are summed to calculate the share price of the company that is warranted by the anticipated future cash flow, based on the geometric mean of its growth rate. A comparison between this price and the current price is another way to see how cheap the business is currently. For further details on what the below terms and numbers mean, consult Cowley (2019).

High Growth Period

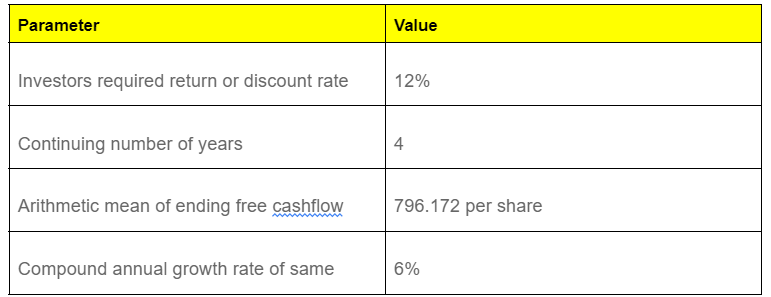

Table 1. Parameters.

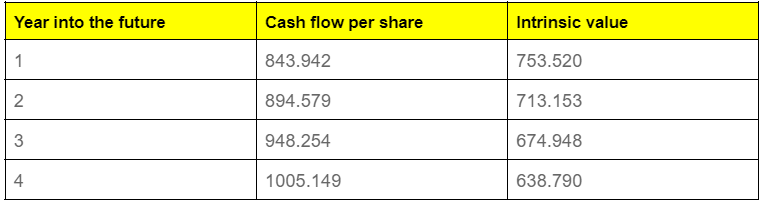

Table 2. Cashflow for high growth period.

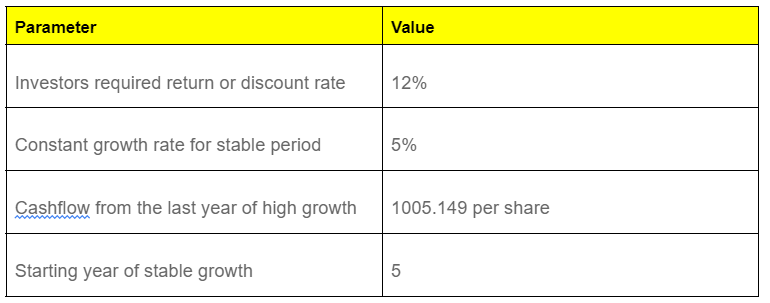

Terminal or Stable Growth Period

Table 1. Parameters.

Table 2. Cashflow for terminal or stable growth period.

Table 3. Intrinsic value of the business.

From this calculation we can see that, from the perspective of future cashflows, the intrinsic value of the business supports a price of KRW12362.266 per share. Note that this is only true if the following assumptions are correct:

The business grows for the next 4 years at a high rate of 6% per year.

The business grows perpetually thereafter at a rate of 5% per year.

The margin of safety should guide buying decisions in case these assumptions are wrong.

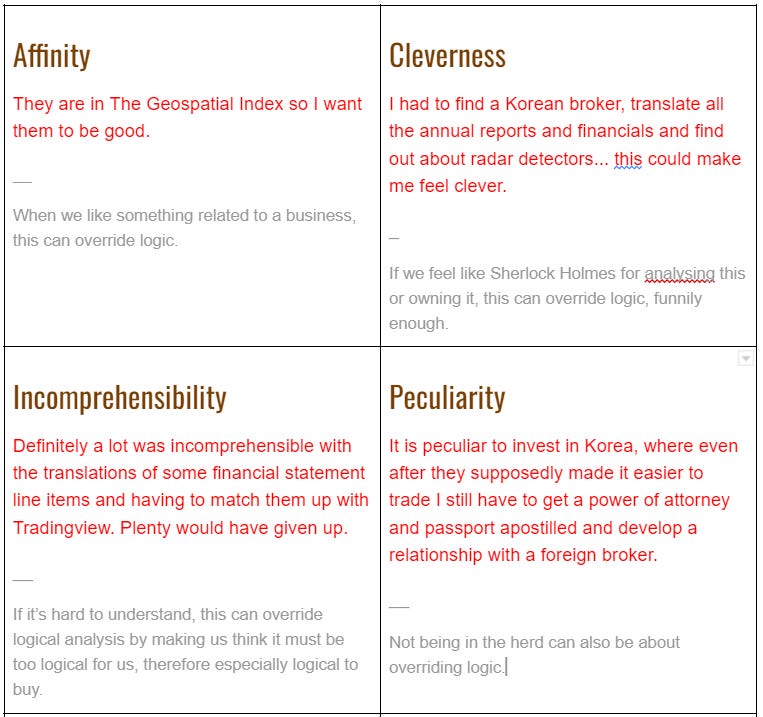

Any Biases to Watch? Yes:

A negative behaviour gap occurs when emotions override logic, or when cognitive biases stop us perceiving the business as it is.

Conclusion

Because they’re in the index, I suffer from the affinity bias and I want them to be a buy. The only problem is, I can’t ignore the rule of customer breadth. 90% of their revenue comes from just 4 customers. This means at least 1 customer accounts for more than 20% of sales, giving customers great bargaining power. They also confront a strong threat of substitutes. As such, one would not choose this company in the presence of other options with good customer breadth and low threat of substitutes. In other words, we’re looking for a company dominating a fast growing niche. Dashcams are a fast growing niche but they do not dominate it. In fact, Garmin, the first company reviewed on this blog, has more devices with a 4+ rating on Amazon.

Garmin 010-02504-00 Dash Cam Mini 2.

Garmin (NYSE:GRMN)

This is not investment advice. I am not your fiduciary. This is not the opinion of my employer. Here is the inaugural equity analysis for The Geospatial Index. If you want to view this as a Google doc, click here. I have a Google sheet that spits these out using a handy extension called

References

BG T&A Co material: https://www.bgtna.com/en/. You can also download the Business Reports from Dart by setting the browser to translate to English and searching for the ticker 046310. Then submit the reports to Google Translate. You can also translate their announcements here.

Wil’s Value Investing Tool.

Cowley, Alistair (2019). How to Value a Business. Accessed 2020-03-09: https://growthwithvalue.com/intrinsic-value-ebook/.

Marshall, Kenneth Jeffrey (2017). Good Stocks Cheap: Value Investing with Confidence for a Lifetime of Stock Market Outperformance. McGraw-Hill Education. Kindle Edition.